Dismiss

Innovation

A platform built for AI

Unified, automated, and ready to turn data into intelligence.

Dismiss

June 16-18, Las Vegas

Pure//Accelerate® 2026

Discover how to unlock the true value of your data.

Dismiss

NVIDIA GTC San Jose 2026

Experience the Everpure difference at GTC

March 16-19 | Booth #935

San Jose McEnery Convention Center

10:15 Webinar

Quant Trading and Formula 1: What’s Needed to Win?

Quant trading and auto racing may have more in common than you think. When microseconds matter, the best technology and seamless integration are key.

This webinar first aired on March 13, 2024

The first 5 minute(s) of our recorded Webinars are open; however, if you are enjoying them, we’ll ask for a little information to finish watching.

Click to View Transcript

Hello everyone. Bruce Morris from the Tab Group here. Welcome to Market Structure Wave. Last month, Tab Forum published a very insightful article on the similarities of plant trading and auto racing. Today, we are very fortunate to have the article's author Victor Olmedo, global Analytics, staff,

field solutions architect for pure storage. Join us on market Structure Wave. Hey Victor, welcome to Tab for Hey Bruce. Thanks so much for having me. I'm really excited to uh dive into the the topic at hand and thank you for the opportunity to chat with um the folks that watch that phone. Uh You're welcome.

So Victor to get us started today. Uh Could you help us and the viewers understand your role at pure storage and specifically what is a field solutions architect as a field solutions architect. Um My responsibility is in the domain of analytics and A I I map to a particular geo uh geographic uh group for uh pure storage um and my customer base

are global finance customers as well as telecommunications customers and uh automotive. So, uh in my role as a field solutions architect um helping the teams uh put together uh solutions and solutions to data pipelines and A I pipelines in order to meet customers uh both the technical objectives as well as um their strategic objective.

Thanks for that. So you wrote a very comprehensive article comparing Quant Trading to auto racing. Can you share with our viewers? What the primary similarities are? Yeah, so I am a big fan of Formula One and have been for a very long time. Um And when we talk about quant trading, uh very much like uh formula one races,

uh formula one, we have a great deal of technical advancement that happens. Um And there's uh a few components that we talk about in the in the post. Uh So, number one, we talk about uh advanced composites and really what we're trying to align there is in this world of quant treating where there were the latest and greatest technology is always gonna be pushed through its limit.

Um And in order to support uh really good and effective A I and analytics applications, um you need to be able to support with uh any, any type of data dimension that's coming in into your A I and analytics pipeline. The other aspect that we looked at was really on board and track site analytics. So the great, the best comparison we can make here is um the real time nature data.

Um And when we're looking at those formula one and we're looking at quant trading, uh the reality is we're looking at real time, you need to be able to satisfy huge amounts of data coming in from um various different sources and very different formats and put that all together in a real time view. Uh That allows you to see the market what's happening uh and be predictive.

Uh our formula one team that responsible uses analytics to understand the weather uh and understand how it's going to affect, affect their overall um strategy for trying to win the race. The other aspect that, that I really love to tie together is really that it's quite um quite a dance when we talk about formula one and it's very, very well choreographed.

You have multiple uh components that not only in the car that are, that are, that are important and need to be fully in sync and tuned for the best possible performance tuned to win. Um You also have uh all of all of the aspects of the human factor that are influencing and, and contributing to delivering that orchestration.

Um When we talk about trying to draw that analog further into quant treating, um we really need to apply discipline to the uh to, to doing discovery um via a INML um And typically, that drives uh a well, very well structured C I CD approach to not to understanding models uh creating new models and delivering new models from results.

So you can have the best predictive capabilities from the data sets that you have and last but not least a platform for winning um success and failure really is a part of three components. Uh driver car team, everything else is the same. So when we look at, when we try to draw that analog to uh quant trading,

the important thing is the important thing to note is that iteration is gonna be the dis distinctive differentiator for anyone in the quant trading space. Assuming everyone now has, right, the the same platforms, the same technology, the same tools uh really iterating quickly and discovering fast is going to deliver a market leading differentiation for uh our quant trader and um

folks. Great, thanks for, for sharing. So, so Victor, one of my favorite analogies in the article was how you compared fuel for the race card to data for the quant trader. Can you, can you expand on that? Yeah, of course. Thanks for that question.

Um So when we talk about fuel, fuel is is the underlying thing that drives the formula one car, right? Um It's all been standardized et cetera. But uh data when we talk about the quant space is really the field that's going to provide um some uh new perspective and new novel views that can be uh that can

be differentiating for, for the models that are trained on that data. So when we look at um the types of data, uh we have uh unstructured, we have uh a lot of time series data, their operations that are extremely metadata, uh heavy having somewhere that you can land your data uh provide a very consistent fuel source for your computational efforts as well as your GP U models and

training and inference jobs means that you no longer have to worry about the data persistence. Don't worry about the fuel. We uh we can provide a very stable uh performance platform to support uh this very advanced machinery up stack. So Victor um wrapping this up and trying to use the appropriate metaphor here.

Can you share with our viewers uh a look into your garage. Uh Where do you see the technology headed and, and what are you working on working on now that will benefit quant traders? There's two things that I see really um being developed um in quant trading space, we typically see a building out of what we call expert systems.

So systems that are used by folks that have phd S that are data scientists that have a great deal of um academic as well as practical financial industry knowledge. And uh and those expert systems are usually very, very bespoke what we're also starting to see as other parts of the of the chain and hedge funds and alternative trading, look at ways to create novice systems.

So a novice system would be a system where someone like you and I can go in and ask new questions of the data. Um So drive new questions around correlative uh no novel correlations that can happen, say between uh image data of a store that shows you how many people are coming in and out of a store to tie it to sentiment, to, then to tie it to some sort of um trading,

low, low latency, high frequency trading strategy. And that is a very exciting part because it effectively democratizes and up levels this very niche uh effort and and high value effort that has been worked on over the last 10, you know, 10 plus years um and allows new people to ask new questions of the data sets. And that's very exciting and I see that across

multiple customers uh within my area even with no, that's, that's great. It, it, it brings those solutions to uh a larger population uh for your clients. So, thanks so much for sharing your time and insights with Tab Forum today and for our viewers who may have missed Victor's article in Tab Forum.

There's gonna be a big red button at the end of this interview that will take you directly to the article. Thanks for stopping by for what was hopefully an educational and entertaining ride on tap forums. Market structure wave. Thanks again, Victor.

My pleasure. Thanks.

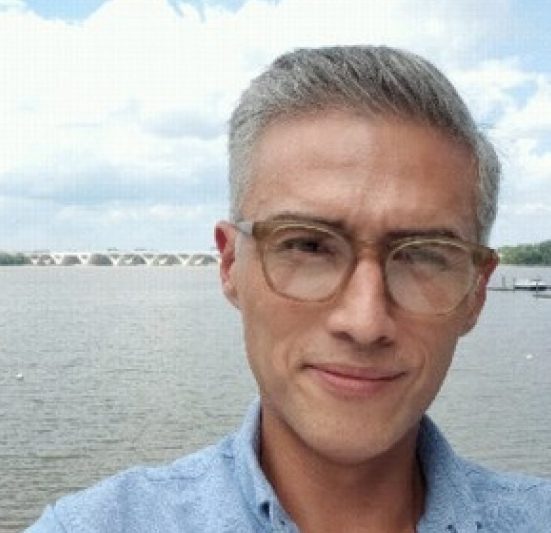

Victor Olmedo

Global - Analytics & AI Principal FSA, Everpure

In this edition of the Market Structure Wave video series, TABB Group CEO Bruce Morris and Everpure Global Field Solutions Architect Victor Olmedo talk about the common demands of quant trading and Formula 1 racing. They’ll discuss:

- Looking at disparate data in real-time

- How a well-structured CI/CD approach can deliver the best predictive capabilities from your data set

- The three components of a winning team

We Also Recommend...

Personalize for Me