Dismiss

Innovation

A platform built for AI

Unified, automated, and ready to turn data into intelligence.

Dismiss

June 16-18, Las Vegas

Pure//Accelerate® 2026

Discover how to unlock the true value of your data.

Dismiss

NVIDIA GTC San Jose 2026

Experience the Everpure difference at GTC

March 16-19 | Booth #935

San Jose McEnery Convention Center

42:59 Webinar

Get Promoted for Running Greener Data Storage

Explore the underpinnings of Everpure’s energy- and space-savings advantages which are especially beneficial with today’s recessionary, macroeconomic environment and increasing energy scarcity.

This webinar first aired on June 14, 2023

Click to View Transcript

Hi, everybody. I'm Elizabeth Rubin. Hi. So good to see everyone. Thanks for coming. Um So we'll, we'll kind of do quick introductions here. Um And then Don, I'll hand it over to you. So, um I am uh es an environmental social governance controller for pure storage.

Um I report into the office of the Chief financial officer. So Kevin Chrysler, and you're probably wondering what is this ESG controller doing? And it really is a new and developing role where we're really, you've heard of financial controllers? Well, now you start seeing us doing more controller over environmental and social reporting, getting us ready for regulation,

thinking about integrating environmental and social capitals into our traditional financial models which totally ignored those aspects of business and those risks and opportunities. So this role is starting to emerge. There's my equivalent in Google Sales Force, Netflix Meta. I'm part of a Silicon Valley Consortium of these new roles that you'll start seeing emerge.

So that's a little bit about me and, and why I'm here and I'll hand it over to Don. All right. Hi, everyone. My name is Don. I am the tech lead for product sustainability at pure, relatively new in the role, been with pure for almost 5.5 years now, but focused on product sustainability for about the past 7.5 months.

As far as what I focus on, it's all about making sure that pure continues to deliver on these savings that we're claiming the 85% less energy, the less e waste, the. So all the things that not only, you know, customers see on your end, but also when you're done using the products, are we disposing of them in an environmentally friendly way?

Are we developing products that are going to last for the 10 years when we say they are, are they really going to last that long or is that just smoke? So my job is to make sure we continue to deliver on that and don't deviate. So that's, that's me. So let's dig in, let's dig into the presentation.

So, mm, well, there's a lot of words on this that I'm gonna, I'm gonna skip over that one. and just go to my talk track one more second, folks. Whoops. So do do do. All right. So I'll probably start off by mentioning a lot

of things that you're aware of. So, you know, at the risk of stating the obvious energy prices have been increasing for, for, you know, especially, you know, recent months since say 2020 a mia most acutely where, you know, they're getting spikes in energy costs, special electricity can double just in a matter of a few months. So if you were running a data center in 2020

you had these operational costs associated with electricity of just a few 10,000 a month. And you are happy with that. You know, you might not care so much about electricity. But when that 10,000 per month increases to 100,000 a month or 500,000 a month, just for electricity, you start to tune into these things.

Also sticking with the Europe example, since 2010, the demand in data centers has grown as well. So we already know that obviously the need or the demand to store information grows every day. There's new users being added, new applications, new types of data. There's a I Cryptocurrency, machine learning, all these things are driving the need for more data storage.

And so again, you can imagine the demand for electricity to run these data centers is is growing. So um you know, quite a bit of um impact there. And and so if we try to net that out in terms of like a a regional number or what, what they're getting in Europe, if we, if we take the um the estimates for annual electricity consumption Europe alone, 90 terawatt and then using

kind of regionalized pricing across different countries, we kind of had to spread it out. It's hard, Europe has different prices depending on the country obviously, but that nets out to around €14 billion. We actually base this data on a white paper that new tennis of all people did. So we're using their research and their numbers and we just kind of ran the same model and we

arrived at a similar number. So it's not just pure saying this, you know, kind of across the industry. It's recognized that Europe is facing some pretty steep energy costs moving forward. Um In the keynote earlier today, you saw Charlie talking about, I think it was Charlie, Charlie and Sean talking about,

you know, the the fact that globally data centers are consuming anywhere between one and 2% of of all electricity generated, this number is probably even higher. So if you are someone who looks at this area a lot, if you add in internet communication, telecom spend, if you, if you add in Cryptocurrency mining, these numbers grow to actually 4%. So this 1 to 2% is a conservative estimate on

what data centers and kind of the traditional way you think about them. But this number could actually be quite, quite a bit higher. We're trying to stick with the more conservative approach. And then if you think about a data center, it's made up of servers, it's made up of storage, it's made up of network switches and then there's some cooling

so that everything doesn't overheat. And if we break that down, we arrive at this 20 to 25% of energy in data centers is consumed by storage. So looking at this and taking it into a global perspective, we're able to see that this this number actually gets quite a bit higher as well. I think I have it on, I guess I just have am on the next.

But taking those numbers and applying it to data centers, there's a massive opportunity around cutting electricity costs associated with storage. Um And again, because pure is uniquely positioned in this space to, to really, you know, give you a differentiated energy savings number when using all flash. Um We feel like it's really a no brainer for customers to start thinking about this,

adopting this, especially if they have sustainability goals, energy reduction goals, net zero goals, our products really fit nicely into that type of an approach within the data center. All right. So I'm gonna switch gears a little bit and let Elizabeth talk a little bit more about sustainability and compliance.

Um And, and why, you know, we think today more than ever, this is something that customers need to begin focusing on, need to begin thinking on because it's not just gonna be optional anymore. So great. Yeah, thank you. Um So, so a little bit of background I didn't share before.

I've been over 20 years in corporate finance. I've spent a ton of time uh you know, finance background MB A and interestingly it's starting to intersect with environmental, social and governance and really understanding the business aspect of environmental social governance. So before we really get started, I'd love to just level set on what ESG really is and,

and mostly about our topic of sustainability. Um So if you take a look at this, it's not philanthropy, it's really thinking about how do environmental and social aspects around us impact business performance and profitability in the short medium and long term. Um So it really is integrating those factors. And if you think about our current financial

models today, totally ignores that it doesn't capture our reliance on natural capitals. It doesn't capture our reliance on social capitals and human capital, right? It's kind of like, ok, financial capital is the only thing that matters, right, risk and return, but there's an aspect of impact that we're having and that our resources that we're consuming.

And so really what we're trying to do, at least as a corporate world is to start integrating those aspects in and understanding the risks that they pose to our business and the opportunities that are going to continue to develop as we move into a low carbon economy. Um You can also take like PG and E that they, you know, they provide a ton of energy out in California and they had this Great ESG report.

Awesome. All of a sudden, we had massive amount of fires, we had huge climate events and they went bankrupt. So where was that in the financial statements and his investors, wouldn't you have wanted to know that they had massive exposure to environmental risk completely outside of their financial statements?

And yes, it was nice in this, like, voluntary report out to site look really pretty. But the reality is, is that it's becoming more and more of a business imperative and reporting on that in a reliable and consistent way is getting more and more important, right? So, so if you even look back 100 years ago, the financial systems that we have today didn't even exist.

Part of the Great Depression was coming out of that was saying, hey, we need to have reliable, dependable, consistent um decision, useful data on financials, right? So that was just, you know, 100 years ago. And now I think it's not that far of a paradigm shift to say what if we started including

natural capital in addition to our financial models. So that is really what we're starting to think about here at pure and a lot of what my role is really contemplating. Um And so really, so when we take a look at pure storage, these are our kind of business relevant, environmental social points,

right? Each industry will be different. But for us, we're really also seeing our impact and our business opportunity is really going to be in lowering energy reducing emissions as a result, lowering our real estate footprint. And as a result, having positive impact on biodiversity and water usage and then lowering e waste, which is truly impacting a lower environmental load.

So it's it's coupling business opportunity and also understanding your risks with sustainable outcomes. And so if I just kind of take a look at this, like ESG is becoming part of just fundamental business strategy and you'll start seeing that there's table stakes right now if you take a look at just our credit rating. So all of your treasurers know you have a credit rating,

it, it drives the cost of debt. Cost of debt is bad. If you keep going up ESG rating ESG rankings and ratings are being included, almost 85% of your credit ratings for your company's debt. So if you are a bad actor, your cost of debt is going up, which is not good. And also there's business opportunity,

there's thematic investments. So I've had a couple conversations with our sustainable investors who are saying we want to get you into these equity funds because you sustained, you're not only driving business value, but you have a sustainable story. You get access to new equity markets, you get more demand for your stock and that's value for the business. So there's huge opportunities here and there's

also table stakes. And so as we keep thinking through this, what does this really mean? And you're starting to see something really, really fundamentally change in organizations and that's the Chief Sustainability Officer. So five years ago, that Chief Sustainability Officer was in a silo and they were thinking

about, you know, their waste and their cafes and how to run their philanthropic foundations. Now, that Chief Sustainability Officer is becoming a cross functional influencer for business decisions because they're helping us get ready for what customers are gonna ask for investors and also regulators and I'll get more into the regulation. And so really that role is fundamentally shifting and for the first time,

that role is starting to talk to the executive office, they're talking to boards, investors and customers. So that is something I I worked at vmware for 39 years and three of those years. I was really working with our chief sustainability officer and that was the challenge she was having. How do I talk to the board? What do I say to investors?

What do I say to customers? Because now their role matters and they're going across and they're helping change decisions at the business level. And so that sphere of influence is changing. So when you're thinking about selling, these are the people who are helping influence on that. So don't listen to me, you can also listen to the numbers,

right. So 97% of the execs expect climate change to impact their strategy and operations through our surveys. Uh two thirds of those believe that sustainable materials and low emissions are going to be driving a significant part of that impact to their strategy. And right now, if you look at science based target initiatives,

they're really the ones that are trying to drive to the Paris Agreement, which is reducing our climate. So 38 trillion, which represents about two thirds of our assets under one third of our assets under management globally have set science based commitments or targets already. These are voluntary, right? So big money companies that represent big money

are in that. And then 85% of the companies that we have surveyed plan to increase their spending. So kind of the signal and the noise is that C SUITE is getting attention on this, they're making big commitments and then on top of that money is going to start flowing here. So what does that really mean? And I'd love to dig into the supply chain

specifically because I think that's what this audience is also thinking about is we are suppliers to our customers and that this is another big trend that's starting to happen. And we're seeing this as well is that in our surveys, we had 85% of organizations have eliminated a supplier because of some level of ESG issue. And um, even just this week, I went through that ESG heads of ESG we have data

platforms that can go crawl the net and we can see like which suppliers are leading and have science based and we can see those that don't. And so then you can start being really, really informed on what partner do you want to work with. Right. And you can start being exclusionary. And again, that's back to that Chief Sustainability Officer,

having broader influence on business decisions that they were never included in five years ago, 10 years ago. So these are, these are big changes that are starting to happen. Now, let's think about regulation. Right. So, right there, I was just talking about the capital markets. We're driving all of that, no regulation,

voluntary reporting. Everybody's just trying to make a change because that's what uh we know that we're dependent on these natural capitals. So today, there's a whole bunch of voluntary reporting. If you're familiar with any of your ESG reports, you'll see gr I you will see un sustainable Development goals, the Greenhouse Gas Protocol, all voluntary,

guess what? We get to choose what we report on and it doesn't have to be consistent, reliable or audited. So how are we making investment decisions on that? Right, because that's how investment decisions are being made. So, incomes are regulatory folks. So this middle part is really what is starting

to emerge and why my role is even starting to exist is that these regulators are saying, hey, hey, wait a minute, these are business relevant, investors are making decisions on this. Capital markets are making decisions and it's all voluntary. Like if this is really important to your business, we should start being regulating on

this information So you're starting to see the sustainable Accounting Standards Board. Uh the uh ISSB which is the International Sustainable Standards Board task force called climate related SFDRESRS. Anybody who's from Europe knows those starting to get into the mandatory, right? So all this voluntary work and now it's getting mandatory. Now it's getting real because you're getting

into the financial statements and you're starting to have to get certifications and you have to get certifications on your emissions. Um And this is a fundamental changing landscape, right? That all of us are kind of navigating. So kind of where is this happening today?

Um You will see we have the SEC. So right now the US is behind where the rest of the world is currently going. We're seeing the ESRs which is the, the EU regulation coming in. Um TCFD is very, very prevalent and you're seeing them in Australia, Singapore.

Um You're starting to see them more and more in Asia. And so basically what this is really getting at is that although the SEC, you know, the US hasn't yet gotten here, what we're seeing as impact is that because Europe is now requiring their, their regulation is saying, hey, your suppliers need to make sure that you're free of conflict minerals.

You have to make sure that you're not having forced labor right into your supply chain. Pure storage is now a supplier to those companies and guess what our customers are going to start asking us, what is your emissions for your product? Do you have forced labor in your, do you know you have forced labor? And so even though we're not regulated because we're here in the US by indirect,

we will start getting those questions, right? So that's what we're trying to get to. And the good thing is this regulation is not yet here, but we're absolutely preparing for it because without that preparation, you know, our competitors are going to be able to provide that information and again, they can be exclusionary.

So net net, let's bring it back. Um Really what is the pure sustainability business value? You know, our products use less energy. Therefore, we have less CO2 emissions, right? That's what we're being valued on lower real estate because we have this small size. Awesome. We can start thinking about having less space

to impact biodiversity, less water used. And then if you think about less e waste, you have less environmental load. Business value is this is what my boss loves lower TCO. So you can start getting more margin, more budget to go do other things and then also be customer and regulation ready. So when the,

when you know, we have to start providing into our 10-K our emissions, we understand what that is and we, we've had them verified, we've had them audited, we're reliable. My boss can sign off on it and know he's not going anywhere because it's true. Um and then customers, right? So being prepared to answer our customers

questions. So, um that's a little bit about the environment. Uh the what I'm working in and then I'd love to hand it back to Don, who's then gonna dig more into the details, right? Like the math behind the pure storage. It's not all math. So it won't, we won't be that,

that, that sleepy. Um But it sounded like Chuck is, is pushing for Kevin to get pushed out though. I mean, he, he, he didn't seem like a big fan uh regardless. So let me move forward. Ok. So I want to start off by, by showing kind of a real world example of a customer that we worked

with recently, um, that, that did just 10% of their storage um estate and this is a large global financial institution. Um This is across five data centers and we, um, took out some, um, you know, not the latest and greatest but some pretty popular, um, hybrid storage that had flash, it had fiber channel kind of spinning disk and then some near line and the, you know, the savings again, just for 10% are pretty dramatic.

The electricity, you know, well below the 85% that I told you pretty much everything lines up with our claims space 94%. So we're not quite, at 95% less but reasonable. Same with emissions, you know, emissions are difficult sometimes when we're giving you a broad answer because they vary from location to location, country to country.

It's hard to give you an exact emissions reduction. All depends on where you are, what your grid mix looks like and so forth. In this case, I was able to look at the data centers where they were located, get the carbon intensity of electricity and kind of come up with an emissions reduction number. And you know, it sounds like a lot of 819

metric tons of co two is quite a bit, especially in a business where they're not manufacturing any products. They're just a finance company. That's a big portion of their emissions right there. I mean, obviously they've got other stuff that they're running and, you know, this is 10% of their equipment but being able to reduce their emissions by 820

metric tons is nothing to sneeze at. And that's an annual savings. It's not like it's one time it happens, you know, at that point forward and just as an equivalent, you know, it's the equivalent from not burning 80 80,000 gallons of gasoline, so reasonable. Um, another thing that we've talked a lot about you, you've probably seen at this point all

kinds of different percentage savings. How did you know, 85% less than this? 10 more reliable and so forth. I wanted to dig into one of our stats, probably the most prominent one and it's our 85% energy savings because we do get questions about that quite often. And how did you get it?

What did you compare? Um What do you, are you just making it up? So, um the genesis for this 85% number is actually a, a life cycle analysis study that we had done by a third party. Um a company called um WSP, they um did both a life cycle analysis and a comparative product analysis. So they looked at our product,

they looked at two other competitive products, I'm not able to name, but they looked at them, they looked at the component data, the tear down what the components consisted of as far as um carbon in uh carbon content when the products were running, how much electricity did they use? And we arrived at this really kind of eye popping, 85%.

And, and you know, the, the executives that first saw this and said, wow, that, that's pretty incredible. Is that true across the board? Is it just those? So they kind of became my task to kind of go through and look at the other products that are out there. Um Not only our flash array but also flash blade.

Um and, and kind of check, you know, how do, how do we line up versus the competition? So we, we kind of, I won't say stole, but we borrowed the same methodology that WSP did. They, they kind of gave us their model and the way that they did calculations. And so I simply took, you know, other products that we have across our portfolio and ran the same analysis and, and just simplifying it a bit, we would pick a fixed capacity

number one, that's kind of in the middle of what the product supports. We'd also balance that with looking at our sales win loss reports and say, all right, for say flash array X 70 what's the most common product it faces from one of the other vendors out there? What did they configure as far as drive sizes capacity?

How much performance was it a you know, one of their high end arrays or was it, you know, one of their low or mid tier products? And so we really tried to line up capacity and performance and then based on those kind of two fixed values, we then go through and look at the spec sheet. So I'd go to the vendors website, pull up their tech specs,

look at what it would take for rack space. How many drives can they fit per expansion shelf? What's their typical power consumption? A lot of vendors are nice enough to list what their nominal power consumption is of their product, both for their controllers and for their expansion shelves, which is nice, not every vendor does it or makes it easy to find.

Sometimes I've got to go to a reseller website to find out what it is. But in general, for, for the, the vendors that are out there, you can find the information that's publicly available. And um the other kind of nuanced piece of this is some companies will guarantee data reduction. They'll say we're going to give you 4 to 1 in

writing. And that's nice from a customer perspective, you know, you're going to get the capacity they told you about. But from a sustainability perspective, it's not as good of a thing because when they miss all they end up doing is costing you more electricity, they're going to ship you more drives, they're gonna ship you more expansion shelves and what you thought you were going to

be spending on electricity just went up because the writing, you know, the written guarantee you had from that vendor meant they had to ship you more equipment. So it's kind of a hidden cost of those guarantees. And so in our comparisons, we would look at the actual data reduction, we would not look at the guaranteed number.

And so we, we work with a lot of partners and vendors and we're able to go out and see for the equipment we're replacing. What data reduction did that customer actually get. And that's really, you know, what drives a lot of this and maybe what some of the competitors don't understand about this comparison is like, no, you know, they, they, they're scratching their heads.

How is the MC? How is how is pure doing so much better? Sorry about that. I was there too long stuck in my head. But how is how is pure delivering on these savings? Right. They've got to be making it up and again, we're basing it on the most common configurations,

middle of the road capacity and then what a vendor is actually delivering around data reduction and capacity. I've spent too much time. So I'm going on this slide, but this is the kind of calculus that we're going through to arrive at that 85%. And this same methodology can be done with our el array,

our flash blade flash array C we've done this before. So you know, this this kind of stands up, what we did find on the flash blade side of things is that since flash play doesn't do data reduction, it just does compression, they're not able to quite get to this 85%. They're closer to say 68 to 70% savings. Still pretty impressive though, in most cases, just breaking down

the 85% a bit more is like, you know what features about a flash array are driving those savings and they can be broken into three buckets. The first one is the drive density. Um I just wanna make sure I'm on my one second. Sorry. Yes. So, so the first one is the drive density.

So our direct flash technology, the the kind of that piece of technology that Sean held up today with the, with the orange heat sink on it, that technology allows us to actually get high performance from higher capacity devices. So if you think about commodity SS D, the capacity goes up and a vendor can say, yeah, we can spec those. But what's happening is though they're losing

performance on those because they have to, a lot of their competing products performance is based on having kind of a whole really wide back end bandwidth. And when you have to, when you cut the number of drives in half for competitors, they're losing that back end bandwidth and they're not able to maintain the same performance level that they were with the smaller, say the 15 terabyte or the seven

terabytes drives. So they, if they're in a performance constrained type of a deal, they're going to spec probably a seven terabyte drive, maybe a 15, occasionally a four terabyte drive in order to meet performance requirements pure. On the other hand, doesn't have to do that. We're able to spec our largest capacity drive. It's going to deliver the same performance that if we had a smaller one,

so it's not a constraint for us. So we can through this direct flash technology really hit our performance numbers and not worry about spindle count or, or really the size of the drives. Um The second part of this is the our data reduction advantage in general. Um I did a quick survey of blogs from competitors out there.

I see no competitors attacking our data reduction claims. We're almost always two x better than everyone else out there. It's just no one wants to contest it again. Some of our harshest critics from a blogging perspective from other companies never question our data reduction. It's because pure has over 100 patents for data

reduction granted and pending, but 100 patents and because of that, we're able to reduce data quite a bit more than our competitors do. I think most architectures out there only do data reduction when the data is on the way into the array. And then that's it. We're doing it on the way in when we persisted out to the flash media and we're coming back

later with deep compression. So we're taking three passes at data reduction on the array, whereas the competitor is doing it one time when the data gets written end of story. So that's what's really driving our data reduction. And then finally, from a system efficiency perspective, if you've been following kind of the evolution of flash array X,

you'll see that with our XL. Now we're able to in five U fit 40 dms whereas before we were limited to 20. So we're also through system efficiency, drive greater density of storage that way. And then also from a software design perspective, because the operating system is aware of what's happening on the back end media, we can control when garbage collection runs,

when things get mapped or if they need to get remapped or not, and we're able to treat the storage media itself very carefully so that it doesn't wear out prematurely. So we've moved a lot of intelligence up into the operating system that for other vendors sits in the firmware on the commodity drives that are shipped to them from the various vendors.

So they're really kind of missing a trick as far as being able to optimize what's happening on storage. Um And again, I, I won't go through the, I think everyone gets the less power means less, less emissions and so forth. So I won't step. Those are pretty self explanatory.

Um One of the thing I do want to mention many of the claims that we make around the less e waste longer useful life is based on the 10 year life span that we expect from our products. Whereas other vendors, their sales model is rip and replace every 3 to 5 years. So after five years, they're bringing in a new array with us. All you're doing is maybe upgrading controllers.

So it's a very different story as far as you know, over that 10 year period for us versus the competition. And that helps drive this e waste reduction, this greater I guess, durability of our product story. All right. Um We, there was a lag there um just drilling into direct flash, just one, taking one more minute to,

to spend on it since we, I think we have a few more moments. The really interesting thing and the thing that I think a lot of customers miss about direct flash is that we really designed both the operating system purity and the direct flash media to be a single unit. They work together as if they're a single entity. So we're not in a position where we're just

designing drives to be fast or just making optimization to our operating system. We've kind of co engineered these together in doing so we're able to remove things that other vendors have to do. And again, I know I mentioned garbage collection but also protocol conversion. So when you think about getting high performance out of disk, you don't want to be constrained by the number of IOS that can be

queued up against a single device. You want to be able to have massive parallelism that NVME delivers. You want to be able to control when garbage collection runs. Because why would you want that to run in the middle of a really IO burst a whole bunch of lights come in, you need to write out to disk really quickly. You don't want the disc deciding,

hey, this is a good time to do garbage collection. I think I'll run because that makes a very, I guess uncertain type of a performance environment. With this design, we have very predictable io latencies and we're also able to um handle the uh what's the other one? Um I should have, I should know these but oh IO scheduling. Sorry.

So the operating system is so the purity operating system is able to directly write to the NAN dies and to the packages. So we can again control how much is happening on a given drive media. We can increase the parallelism. A lot of times the commodity SSD S have a single cue that handles all the reads and rights that are going in and they contend with

one another, we're able to read and write in parallel to the same DFM. And obviously, they would have to go to different dies. But because we understand geometry, we can actually, you know, schedule io for different dies and have reads and rights happening at the same time to the same media. Whereas again, with the commodity approach,

you don't get that luxury, you just kind of send a bunch of commands to the drive and the drive finishes it when it finishes it. And that's kind of the end of the story. So this is, you know, pretty significant. We don't see other vendors or, you know, making a change like this quickly. And for us, these are the rough benefits as far as performance four X more performance density.

So meaning for a given drive size, we're able to get four X more performance than the commodity drive would get. We're also able to, if you're familiar with S SDS, there's some over provision capacity that comes on every SSD that the drive will decide when it's going to use that capacity for us. We're able to use the over provision capacity whenever we feel like it.

So we actually get 20% free extra on all of our flash media because again, we don't have a concept of over provision media. We simply use everything. Is there everything that's on that DFM whenever we choose to and we take care of replacing worn out cells if it's necessary. But again, all of it is controlled at the operating system level,

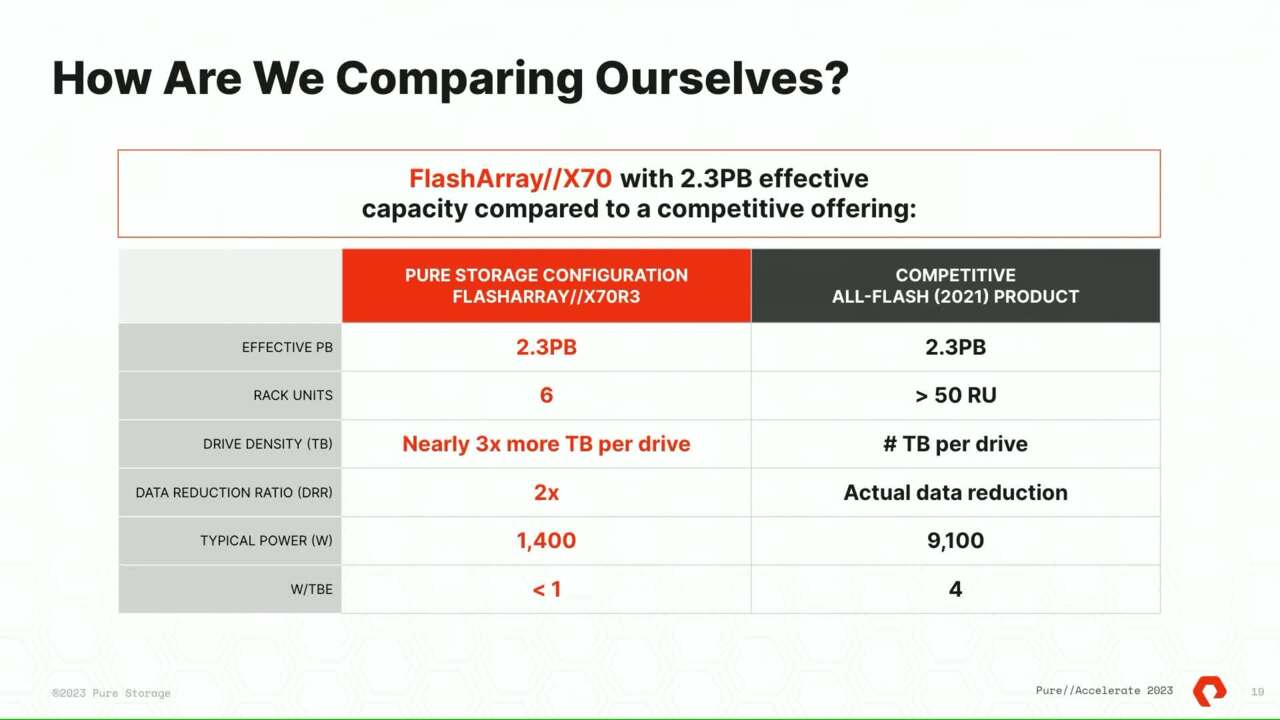

it's not delegated to the drives and what they feel like doing. Yeah. Um So last slide around our, our savings numbers and again, here's a kind of a great picture. Um You know, in this case, this is uh actually two flash arrays on the left that adds up to six U. Um I believe or it's I'm sorry, it's a 34

single array with an expansion shelf. I apologize. And so in six U, we're able to get to about 2.3 petabytes effective with 5 to 1 data reduction, comparing it to a competing solution that's unbranded. We give them credit. In reality, we see them getting about 2.5 to 1. Their solution takes almost double the raw capacity and takes up 52 U.

So again, this is, these are the kind of replacements that that we're able to do. Um We also have a customer success story that, that got a similar space savings. It was me and Formica and obviously you guys can't click on the link here. But if you go to our website and do a search for the customer success story for ELC, they will, you know, kind of back up this space savings claim that we have here.

So these aren't just spreadsheet calculations. Our customers are really seeing these sorts of results when they deploy pure. And then here's our last slide. So here's a guy, you know, going back to the title of this session, it's about get promoted for putting our building a greener data center. Here's two gentlemen that are building a

greener data center and they're taking out, you know, two racks and consolidating down into, you know, I don't know, 88 U. So, I mean, these, these are really reductions that can be realized out there in the real world. They're not just a bunch of numbers that we came up with in a spreadsheet that we said, yeah, they should probably be able to get this.

We really see these, these savings out there. So uh that's it, Elizabeth. Do you wanna go through the calls to action? I think um you wanna wait, I didn't need to put you on the spot. No, that's good. So I think uh you know, any good presentation before we open it up for questions is really just kind of wrapping it up.

So I think really is, you know, reach out to us and help us, help us, help you sell to your customers in terms of how pure can help them solve their business and also sustainability challenges. It's it's all starting to integrate in. Um And then also think about regulatory compliance. Um it's happening in Europe. How does that impact our customers?

The good thing is it hasn't happened yet. We can start reading the tea leaves and getting prepared is just always going to just be helpful and how can we help you um as part of our partners and customers um be able to be ready, right? Because we're getting our data ready. Um so that we can easily report out like we're already starting to get questions in on,

you know, what is, what is our plastic use? What is our metals use? What is, you know, quite a bit of detail and being ready for that is going to be important. And then thinking about thinking about the changing role of the Chief sustainability Officer and just, or the head of ESG and that level of influence across our business understanding, the environmental commitments that customers have made,

will help talk to those to those new influencers in terms of the business decisions for what they're buying and why. And then also just kind of talk to your sales team don and I are here, we're helping our sales crew get the information that they need to go sell this story because I think it's going to increasingly become compelling and we just want

to make sure they have the data to really support what we, what we're doing here at here. So uh less lower power, less space and also less e waste is our big free messages here. So I think uh and so any questions um that you guys have, I I think it's pretty straightforward, pay any questions how

the, you know, the savings and everything is uh absolutely on point. And we provide, you know, you guys are there helping but for the customers who deployed, who are using our gear today that you manage, you will be able to see based on that customers deploy um the space for this to, you know, the amount of energy being consumed versus being saved.

So it's really um your cost savings, less power, less space less EBA. You can actually tailor it to that particular. Yeah, that's a good point. We're working to really surface this data in pure one in the flash array management U I. We're working to get all this data pushed up and visible to folks that run it or to businesses so they can report it.

So again, it's a work in progress but it is top of mind for us. Yeah, pure so. Thank you. Yeah. Yeah. Yes. Ok. Uh Right. Just curious how you and your team. Yeah. Five.

Yeah, maybe you'll have a different answer, but I'll start. So, so back in 2012 when the company was founded, in order for Flash to be price competitive or be viable, you know, we couldn't sell a product that was cost 10 X what was on the market? In order for us to have a viable product, we did have it have to be extremely space efficient, power,

efficient and so forth. They just kind of came naturally to building a product that people could afford to buy. So that's kind of been the genesis. We didn't, we weren't thinking about ESG back in 2012. But, um you know, by, I guess you'd call it, you know,

um good fortune, but also from smart design, um you know, it's kind of carried forward and it's always been part of the products that we sell. Um So that's, that's what got us on this, you know, path, I guess. Um, I don't know, was there a pivotal moment I think for me. So I've been a pure storage for six months now.

So I was doing ESG at VMWARE and actually Kevin Chrysler, our CFO had approached me and he said, hey, you know, sustainability is increasingly important. You know, it, it's important from a business perspective. It's important because we have an amazing product and also you realize regulation is coming, right? And so a lot more CFO S and kind of the Chief

Financial officers are going to have to start thinking about how do we reliably report on their sustainable aspects into the 10-K. So every year, you know, the CFO and the CEO have to sign off for personal liability for incorrect statements into the 10-K. So with regulation coming, we really needed to kind of up our game and add into that more

financial uh level of rigor into prior like voluntary reporting, which is primarily going to be um you know, not audited and probably a little bit less reliable and definitely not comparable across companies. And so I think there is that element and also just the business value. Another thing that I do in my role is take a look at a return of investment,

right? So how do you think, how do you contemplate inner, you know, natural capital and social capital into your investment decisions? Right. And, and how do we make sure we're allocating our resources? So, um so for me, that was kind of the moment, I think it's really starting CFO S are starting to notice now.

Yeah. And I, and I think, you know, to the um and maybe that was the motivation to do the life cycle analysis that I mentioned. I mean, all, all the, I don't think we knew what to expect from the analysis. And then we saw this really well, we actually are doing really well. We weren't sure where we stood. So just, you know,

gaining information, having some a push on the financial and regulatory side. I think, you know, finally got us motivated to get going down this path. Um Right. All right. So I guess that's it. Let us go. Do you have any questions?

Thank you. Thanks guys. Thanks for coming. Cool.

In this session, you’ll also learn the importance of green supply chains and the rise of the chief sustainability officer persona as a key influencer, the increasing clout of ESG investing funds, and the challenges of rapidly escalating governmental regulations.

We Also Recommend...

Personalize for Me